The US-China trade war seems to be long-lasting due to the current affairs between China and the US. The ensuing high tariff on Chinese import makes everyone believe that it will have a heavy impact on beauty industry across the board. Let’s analyze the impact on beauty supply products, especially hair products and cosmetics, and ponder how beauty industry should cope with the situation.

Impact on Human Hair Products

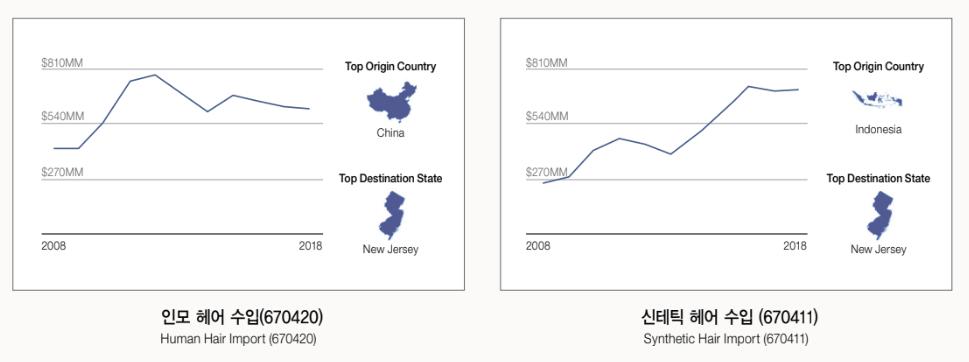

Obviously, hair products are the severely afflicted part if higher tariff is to be imposed. China is the largest player in the raw hair international trade. For example, in 2018 China was the biggest exporter of HS 670420, a human hair wig, while Indonesia was its counterpart for HS 670411, a synthetic hair wig. Mostwigs were imported through ports in New Jersey. As Chinese goods contribute largely to the supply of hair products, a 25% tariff would lead to the increase of the wholesale price. In turn, retail price would increase thereafter.

Weak Yuan Can Buffer Some of Tariff Impact

For wholesale companies who carry stock in high volume may delay the impact of tariff with weak Yuan as a buffer. Nonetheless, in a long run, they need to start thinking about importing from other countries including India, Bangladeshi, and Vietnam for hair products. Just to find and talk to suppliers in a new region, pay a visit to promising candidates, collaborate on product specification, place an order, and receive shipment would take at least six months. Upon the imposition of higher tariff on Chinese imports to the U.S., Yuan is anticipated to be devalued. Yuan exchange is tightly controlled by the Chinese government who heavily intervenes in currency exchange market. Although China has been under a lot of pressure from the U.S. manipulating exchange rate, it would be likely to respond to tariffs with devaluing Yuan. In this case, the price of imported goods would be lowered. At least a portion of increase in price due to tariff can be absorbed by the exporters, and some of the rest will be affected by weak Yuan. Therefore, the eventual increase in price will be less than 25%.

Concerns from Beauty Industry Insiders

Beauty supply retailers in various regions including Chicago, Los Angeles, New York City, Georgia, and Florida all expressed their concerns about the tariff. Most of them were inclined to reduce the procurement on hair products if price soared and were to focus on reducing inventory. Most wholesales we spoke to said they would wait and see how the situation would unfold. Most of the businesses who participated in the interview believed the impact of high tariff would not fall on a single victim as it applies to all imported hair products. An executive officer of a hair company in New Jersey said “though no single company benefits from the tariff or vice versa, some companies who carry higher volume of human hair products might feel it harder” and added that “the worst scenario is that consumers spend less on human hair products due to the tariff”. An interviewee from a hair company in the West region talked about its current procurement policy. He explained “we are not placing orders unless necessary because Indonesian manufacturers’ extra capacity may run out at some point ,whichis unknown to us.” The imposition of tariff would hold importers liable for 25% the value of imports as tariff needs to be advanced before clearing the customs in addition to small customs clearance fees that have been the only required payment for exempted goods including hair products. This imposes additional financial burden on wholesales companies. As such, wholesales with poor cash flow may be hit harder.

De Minimis Exemption on Hair Products

Another issue on hair products lies on the continuation of de minimis exemption for cross-border e-commerce goods valued under $800 per shipment. As hair products tend to have lower proportion of ship-ping costs, they are more vulnerable to cross-border e-commerce. Hair products sold at beauty supplies will reflect the increase in import cost due to the tariff. On the other hand, exempted goods purchased through cross-border e-commerce may stay the same as they are not affected by tariffs. It would produce different results for some e-commerce sellers who are wholesalers importing goods from China in bulk. On the other hand, if consumer purchases goods directly from China, the items as long as they are under $800 per shipment would be exempted from tariffs. In general, beauty supply retailers would have disadvantage on price competition compared to cross-border e-commerce. So far, the government has been silent on tariffs on cross-border e-commerce goods. However, the beauty supply industry as a whole would benefit from tariffs on de minimis shipments. An organized effort of the hair industry in de minimis exemptions is becoming necessary.

A Korean Alternative to Chinese Cosmetics

Facial mask packs that are sold at beauty supplies are mainly manufactured in South Korea, but most color cosmetics are made in China. Therefore, a 25% tariff on Chinese goods would hugely impact color cosmetics pricing. The difference here is the existence of alternatives, namely South Korea and Taiwan. China’s rise in manufacturing industry was backed by the bulk of components produced in China. In cosmetics, fair quality containers for cosmetics are produced in China at a comparatively lower price, which led to the growth of OEM manufacturing in China. For this reason, cosmetics in a low-to-mid price range are mostly packaged in containers made in China. In addition to cheap but fair quality plastic molding being available in China, raw materials, plastic resins, and labor cost is low. These contribute to the price competitiveness of Chinese cosmetic containers. A good number of Korean cosmetics manufacturers import Chinese containers except a few containers with manufacturing difficulties. TheseKorean manufacturers can easily replace Chinese counterparts, making it easier for cosmetics wholesales to find alternatives. For this reason, there could be some back orders due to the switchof manufacturing facilities. A higher manufacturing cost in Taiwan and Korea would bring about a price increase in cosmetics. In turn, wholesale prices of cosmetics could rise.

A close watch on cosmetics market price on other channels such as CVS is needed

You need to consider competing brands that are sold at a similar price range through retailers such as CVS and Walgreen when facing price increase across the board in beauty supply cosmetics. A lot of low-to-mid range brands such as Revlon and Maybelline produce their products in China, so they are under the pressure likewise. On the other hand, some cosmetics brands including Cover Girl produce their goods in America with components imported from China. They are to be under less pressure. These products would undermine the price competitiveness of certain goods sold in beauty supplies. Therefore, you need to closely watch local stores including CVS, Walgreen, and Dollar Tree that have tight connection with the community if tariff plan starts to roll. These community-based retailers are in direct competition with beauty supply retailers. If you find you’re pricing relatively high, you need to seriously consider narrowing your price margin to maintain revenue.

Most Miscellaneous Goods Are Made in China

A non-profit private organization the Alliance for American Manufacturing (“AAM”) estimated 70% to 80% of goods sold in Walmart are Chinese. Statistics is unavailable for beauty supplies, but many miscellaneous goods companies agree that many of their products are imported from China. Therefore, a 25% tariff would raise average wholesale price significantly.

Miscellaneous goods sold in beauty supplies can be divided into different goods produced by sewing and by plastic molding. For goods produced through plastic molding, you cannot simply take molds to another country due to the ownership issue. Plastic products would be likely to continue to be supplied from Chinese manufacturers for this reason, so wholesale prices would have a reason to rise.

Smallest Impact on Miscellaneous Goods

On the other hand, many fabric items sold at beauty supplies can be produced alternatively in Vietnam, Indonesia, Sri Lanka, and so on. Therefore, wholesales companies would move their factories to other countries rather than raising the production cost. Mr. K who has run a sewing factory in Vietnam over the past 15 years told us “people say Chinese manufacturers are looking into Vietnamese sewing plants, but due to the consistent growth of Vietnamese manufacturing industry, they wouldn’t be able to find a factory site near populated cities.” “The farther you are located from the cities, the more difficult you are to find labor intensifies,” he explained. He also said, “Though we were expecting increase in volume of orders in Vietnam due to price increase in Chinese goods, we only received slightly more inquiries, and no significant increase in orders.”Many miscellaneous goods sold in beauty supplies are safe from competition, so the impact of tariff on Chinese goods would be comparatively low.

US-China trade war is a big incident which can have a lasting impact on beauty supply industry. A concerted wisdom and effort of the beauty supply industry has never been more urgent.

Reference: https://www.bnbmag.com/us-china-trade-war-and-beauty-industry/